Flutterwave leads with its single largest funding so far

By Jeph Ajobaju, Chief Copy Editor

From fintech to agrictech and edtech, Nigerian startups are attracting more foreign investors than their counterparts in Africa. They received over $150 billion in 2021, which was 35 per cent of total investments continentwide.

The funds have again been rolling in 2022, traversing pre-seed to Series D. Nigerian startups garnered about $1 billion in the first quarter of the year ended in March (Q1 2022).

Here are the top 10 deals in Q1 2022 which account for $503.5 million of the total:

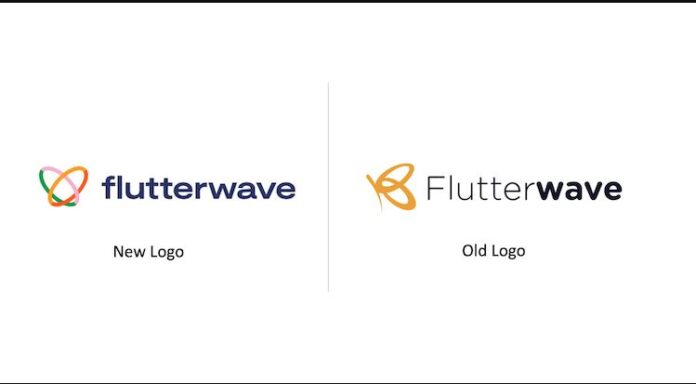

Flutterwave, one of the most valuable startups in Nigeria, became Africa’s fourth unicorn in 2021 after raising $170 million in a Series C round.

It put the icing on its cake in February 2022 when it raised $250 million, its single-biggest funding round to date, valuing the fintech at more than $3 billion, as it targets mergers and acquisitions, and growing its customer base.

The latest series D funding round was led by Facebook co-founder Eduardo Saverin’s venture capital firm B Capital Group and Boston-based hedge fund Whale Rock Capital Management.

“The funding gives Flutterwave the much-needed support to deliver on our plans to provide the best experience for our merchants and customers around the world,” Chief Executive Officer Olugbenga Agboola said.

Moove – $105 million

Moove raised $105 million in an oversubscribed Series A2 round in March to scale to seven new markets across Asia, Middle East and North Africa (MENA), and Europe over the next six months.

Moove, founded in 2019 by British-born Nigerians Ladi Delano and Jide Odunsi, is democratising vehicle ownership in Africa by providing revenue-based vehicle financing to mobility entrepreneurs.

ThriveAgric – $56.4 million

Tech-driven agricultural firm ThriveAgric secured $56.4 million in debt funding from commercial banks and institutional investors in March. It also received a $1.75 million co-investment grant from West Africa Trade & Investment, which is funded by USAID.

ThriveAgric is now able to expand its 200,000+ farmer base, as well as enter new markets in Africa, including Ghana, Zambia, and Kenya.

________________________________________________________________

Related articles:

Mobility 54 invites startup applications for funding

ETAP raises $1.5m for car insurance in Africa

Cassava raises $4m to expand insurance access

__________________________________________________________________

Reliance Health – $40 million

Reliance Health, an emerging markets-focused digital healthcare provider, completed a $40 million Series B funding round in February.

The round was led by General Atlantic, a global growth equity investor, with participation from Partech, Picus Capital, Tencent Exploration, AAIC (Asia Africa Investment and Consulting), P1 Ventures, Laerdal Million Lives Fund, M3 Inc., and Arvanitis Social Foundation, per reporting by Nairametrics.

Reliance Health began operation in Nigeria in 2015 as Kangpe, a telemedicine-focused startup founded by Femi Kuti, Opeyemi Olumekun, and Matthew Mayaki.

It later expanded into a single-fee healthcare provider to better address the complex, evolving needs of patients.

Reliance Health is headquartered in Lagos with offices in Austin and Texas in the United States.

Credpal – $15 million

CredPal is one of the pioneers of ‘buy now, pay later’ (BNPL) services in Nigeria. It closed a bridge round of $15 million in equity and debt in March to expand its consumer credit offerings across Africa.

CredPal says the investment will help support its expansion into other markets on the continent, mainly Kenya, Egypt, Ghana, and Cameroon.

Bamboo – $15 million

Bamboo, a brokerage app that enables Africans buy and trade US stocks in real-time, raised a $15 million Series A funding round in January to accelerate its growth, move into new markets, and launch more products.

The round was led by Greycroft and Tiger Global with participation from Motley Fool Ventures, Saison Capital, Chrysalis Capital, and Y-Combinator’s Michael Seibel, among others.

Bamboo plans to use the capital to accelerate its growth, doubling down on unlocking new markets and launching more products.

SeamlessHR – $10 million

SeamlessHR builds world-class cloud solutions to help organisations manage most HR processes on one platform

It raised $10 million in its Series A funding round in January to expand to new frontiers in Southern and East Africa.

The funding round was led by TLcom Capital, with contributions from Capria Ventures, Lateral Capital, Enza Capital, Ingressive Capital, and private investors.

The new fund, which came about a year after SeasmlessHR announced a seed round, will strengthen its position as Africa’s leading cloud HR and payroll platform.

CEO Emmanuel Okeleji said: “We are fanatical about customer success, and this funding will enable us to invest in the continuous optimisation of customer experience across all touchpoints, adding new features and functionalities to empower our customers even more.”

DrugStoc – $4.4 million

E-health pharmaceutical procurement and distribution startup DrugStoc secured $4.4 million in a Series A funding round in January.

It was led by Africa HealthCare Master Fund, Chicago-based venture firm Vested World, and German Development Bank (DEG), among others.

DrugStoc was established out of a hospital management company, IntegraHealth, founded by Chibuzo Opara and Adham Yehia in 2015.

Opara said its monthly revenue has grown over 1,500 per cent in the past three years, spurred by quality assurance on the DrugStoc platform, which provides a commission for every sale made.

Casava – $4 million

Nigeria’s first 100 per cent digital insurance company, Casava, raised a $4 million in February, the largest pre-seed fund for an African insurtech.

Target Global based in Berlin led the round, with participation by foreign venture capitalists and angel investors such as Entrée Capital, Oliver Jung, Tom Blomfield, Ed Robinson, and Brandon Krieg.

Sudo Africa – $3.7 million

Sudo Africa, a card-issuing API fintech for developers and businesses, raised $3.7 million in pre-seed funding in March.

Global Founders Capital (GFC) based in Franciso led the round. Participating VCs include Picus Capital, LoftyInc Capital, Rallycap Ventures, Kepple Africa, Berrywood Capital, ZedCrest, and Suya Ventures.

Several African fintech founders such as Olugbenga ‘GB’ Agboola, Ham Serunjogi, and Odun Eweniyi are also investors in Sudo Africa.